Award-winning PDF software

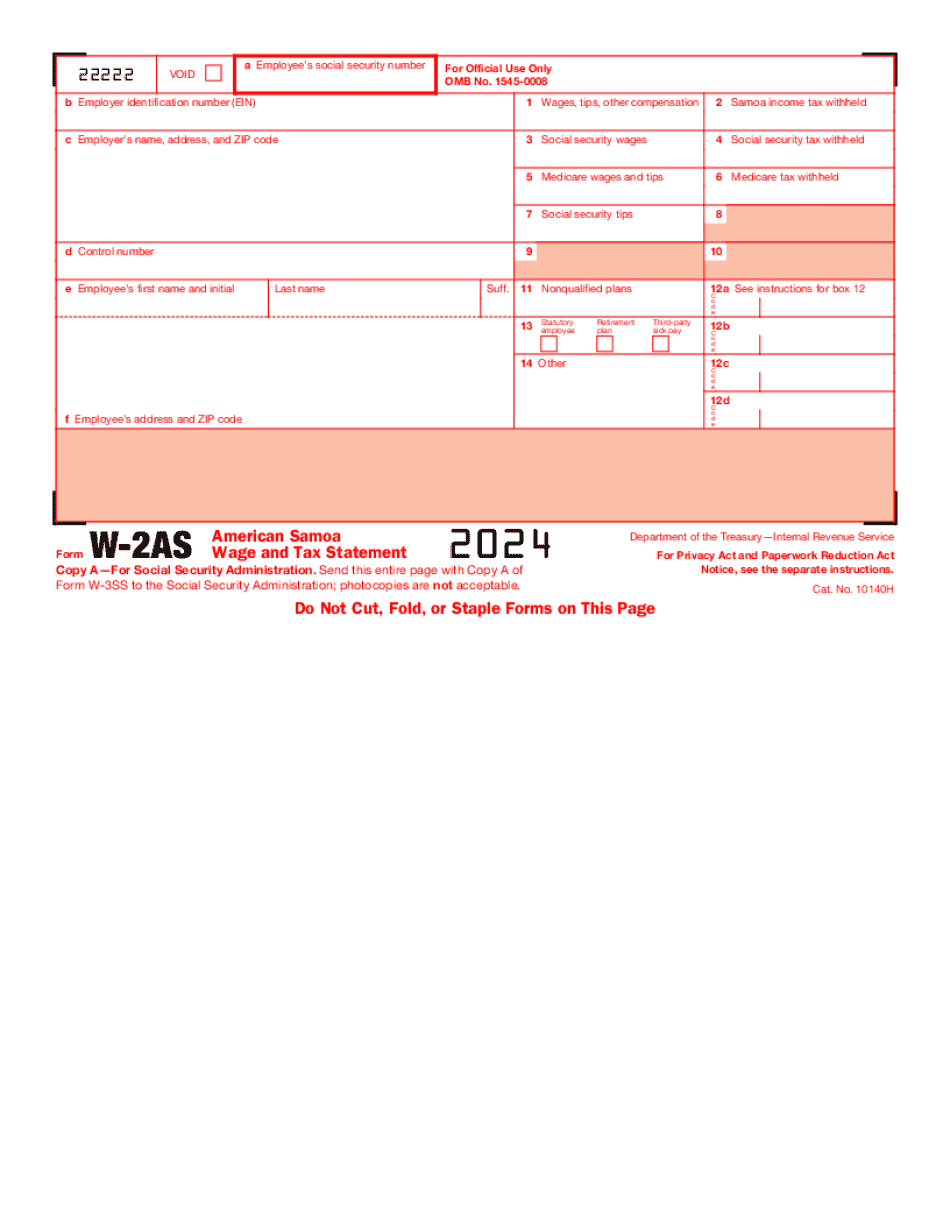

Form W-2AS California Alameda: What You Should Know

This year the W-2 filing guidelines have changed to require all employees over 18 years old to complete a W-2. This change will allow you to submit more accurate information to the IRS while allowing your employees to provide a little more information about themselves. When you have completed your W-4 and completed the appropriate W-8, your W-2 form will be mailed to you via the United States Postal Service. It will take up to 2 weeks for the form to be received. Alameda County's Form W-2, Wage and Tax Statement, is available to all employees, as well as their employers (including your own). However, certain employees, as described below, must receive a separate Form 990 tax return, which is required as soon as the employee first reports tips to the California State Treasurer's Office; and if there is any change in employment (such as a permanent change of job title), the employee must complete, sign and issue a Form 990 before his or her wages are reported to the IRS. For most employees who work under the California labor laws, the employer completes the W-2 and sends the form on the employee's W-2 form. (Note that for employees in the service businesses covered by Wage Act laws, such as restaurants and hotels, the IRS does not ask for a W-2, but you should be sure to have one completed.) Employees do not need to complete any additional this form unless they have the required reporting information as outlined in below: Employees who are engaged in “bona fide” part-time work (not a job that is exempt, like the self-employed), but who receive 4,760 a year or less. Employees whose base rate of pay for a calendar year is 14,080 or less per year. Employees who are on a paid leave of absence more than 100 days (more than the usual workweek of 120 days) prior to reporting to work (more than 120 days for “full time job,” part-time job, temporary job and temporary job employees).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2AS California Alameda, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2AS California Alameda?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2AS California Alameda aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2AS California Alameda from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.