Award-winning PDF software

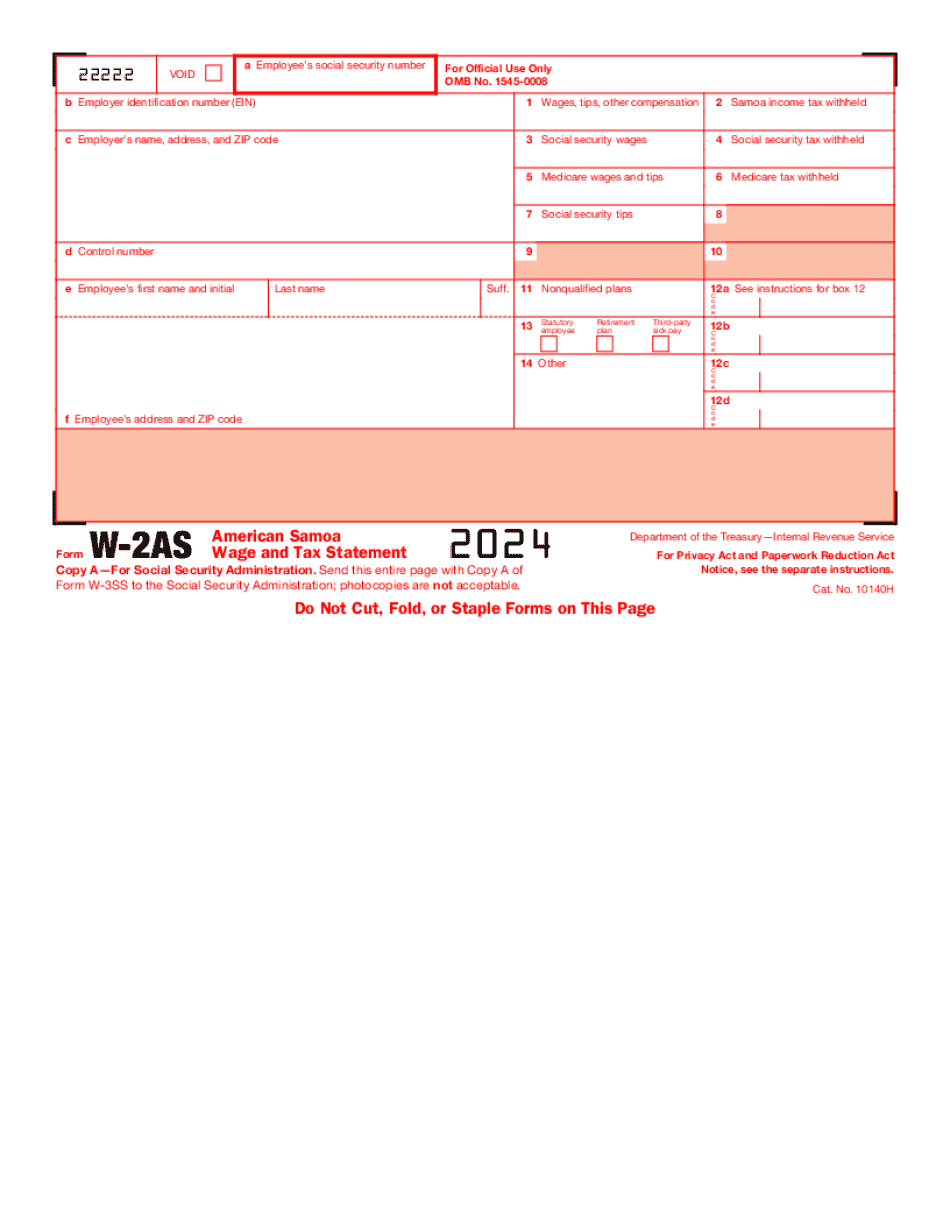

Wichita Kansas Form W-2AS: What You Should Know

Non-Business Use of W-2 — IRS A non-business use of a “W” is a deduction made when a person performs exempt activities or receives compensation, other than wages, that equals or exceeds one-half of his or her adjusted gross income or 400, whichever is less. A person may perform a non-business use of a W-2 if he or she is entitled: to receive social security benefits at the time of employment (unless exempted on the basis of disability); to receive tax-exempt interest or dividends on the value of his or her principal residence or a qualified farm or fishing property, for calendar year 2025 or 2025 only (not for calendar year 2025 only if a qualified farm or fishing property is located in Kansas); to receive any deduction on certain property, including the fair market value of any investment, that is attributable to an increase in an itemized deduction; or to receive certain benefits such as certain retirement benefits, employee group life insurance, long-term disability insurance, medical and hospital insurance, unemployment compensation, federal social security retirement benefits, and federal employee retirement or pension benefits. The non-business use does not include an increase in an allocable amount claimed as a credit or refund by the taxpayer. To avoid the tax, a person's wages must be reported on Schedule C as wages (without regard to whether withholding tax is applied). If you are subject to withholding on the amount of social security benefits under section 83(a), have this amount included as a penalty withholding from your wages. The amount of social security benefits withheld may be included in box 1, line 21 of Form W-2, except that a social security account number or other evidence shall be provided to substantiate any claim that the amount withheld is attributable to social security benefits. Form 8938 with the IRS (not required but can be helpful) If you are required to make Form 3122 reporting taxable income under section 6039B and did not report income in an earlier year, use Form 8938 to report the income. Form 843 (also required as a penalty withholding report for non-business use) Report the amount of income tax withheld and reported on Form 843, Non-Business Use of W-2.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wichita Kansas Form W-2AS, keep away from glitches and furnish it inside a timely method:

How to complete a Wichita Kansas Form W-2AS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wichita Kansas Form W-2AS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wichita Kansas Form W-2AS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.