Award-winning PDF software

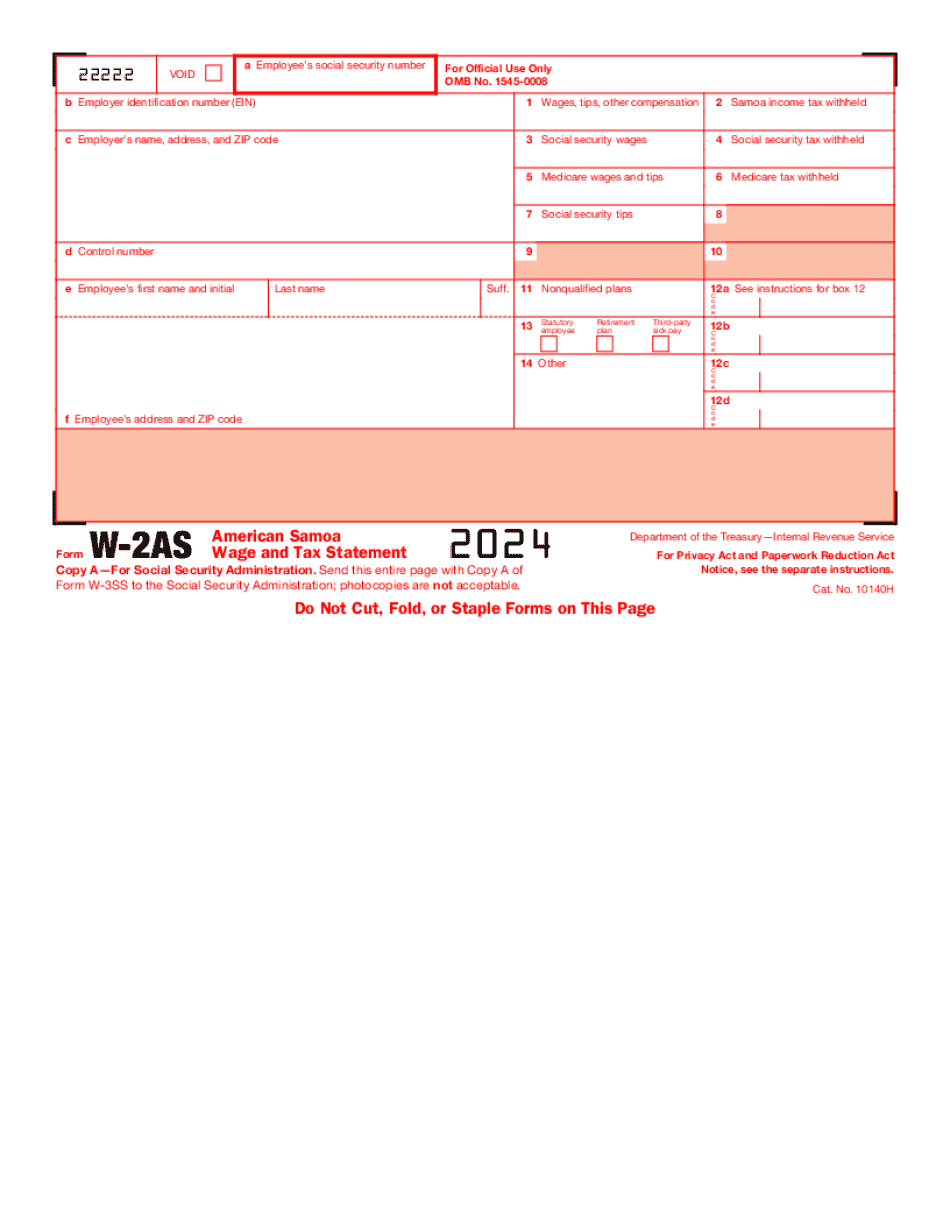

Salinas California Form W-2AS: What You Should Know

The tax rates for 2025 and 2025 are higher than in 2017. These are known as the “hybrid rates”. The tax rates are higher for employees with less than 100,000 in total wages. The 2025 rates for 2025 and 2025 will be adjusted for inflation in 2025 and beyond. You can view the 2025 Social Security and Medicare Tax Rates and Table of Changes here, and the 2025 Unemployment Insurance Tax Rates here. The changes in the hybrid rates do not reduce the rate of pay that you receive from your employer. The hybrid rate of pay does not decrease when you receive a higher wage. What is the “hybrid rate” and how will the tax rates change? It is a common misconception that the rates will automatically go to a lower rate when that employee's wages increase. The wage base, as described in this article is only what you earn, not that part of your income that goes on tips. There is a difference between the two. If your total annual income goes up from 8,853.60 to 10,000, your tax rate will reduce, since 10,000 is a “higher base” than 8,853.60. You are still required to file a tax return, just because your employee's wages increase does not mean you have more free time to sit around. This is another reason why you need to keep a good record of your time and wages. The hybrid rate is a lower rate that depends on the amount of wages you earn. It is a lower rate if your wages go up by more than 4,000. It is a higher rate if your wages go down by more than 4,000. Furthermore, it is the same rate you will have if the federal government were to reduce the tax rate for 2025 by 0.1%. You can view the full 2025 federal income tax brackets here. What is a Federal Estate Tax rate? The Federal Estate Tax is payable on the entire value of an estate or the value of a family business upon the death of its owner. If you are planning on gifting an estate, you can view the latest 2025 Federal Gift and Estate Tax Rates here. Income Tax Rates | IRS What is the “Form W-4” for Wages? The Form W-4 is an annual Form W-2 (and an additional Form 1097), that is filed by employees (except those who work for a foreign employer) at the beginning of the calendar year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Salinas California Form W-2AS, keep away from glitches and furnish it inside a timely method:

How to complete a Salinas California Form W-2AS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Salinas California Form W-2AS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Salinas California Form W-2AS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.