Award-winning PDF software

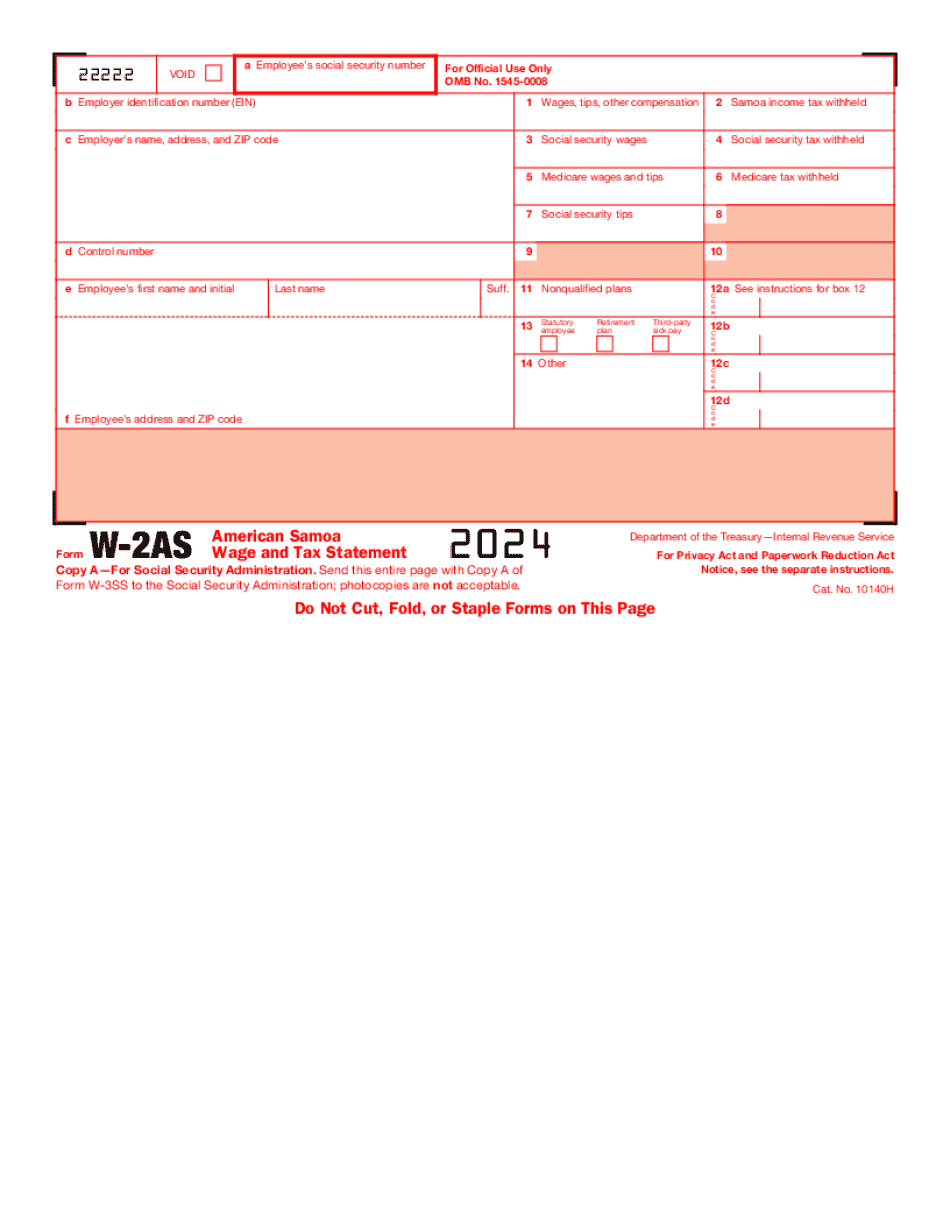

Form W-2AS for Stamford Connecticut: What You Should Know

Electronic filing system (i.e., file) for Connecticut. E-file is available by contacting your financial institution or by downloading and using the Connecticut efile portal. New York and CT Residents Effective January 1, 2018, New York tax withholding for all tax years beginning before Jan 1, 2009, and Connecticut tax withholding for all tax years beginning before Jan 1, 2025 will increase by a rate of 1 percent per calendar year, starting January 1, 2019. This change is effective for Connecticut taxpayers. Connecticut is now eligible for the federal EIS (Electronic Filing Service). The Connecticut government launched the Connecticut E-file website, file. Connecticut's file portal requires a credit card for online payments. Electronic Filing Service (EFS) is provided by Experian. Online and paper return filing are available, along with free online tax preparation software, available at the Connecticut EFS page. The Connecticut Department of Revenue also provides electronic return filing. Connecticut does not have a physical office of filing. The Connecticut Department of Financial Services does allow electronic filing for the federal EFS. Information for Taxpayers — Connecticut Revenue You can electronically file a return online using a credit card on an Internet-connected computer. Online payment must go through a provider who specializes in online transaction processing (think PayPal, Stripe, or Braintree). If you pay using a credit card, the provider will charge the user's account a fee, usually around 1–3. Once the tax return is processed, return filers can get their refund by mailing a copy of this return (only the Form 1040, Schedule A or a Schedule C returns are mailed without a return receipt). Or, taxpayers can get their refund by presenting a paper copy of the return to a local IRS office. The deadline for filing returns for tax years 2025 through 2025 is Tuesday, October 10, 2018, at 5:00 p.m. EDT. The deadline for filing returns for subsequent years is Monday, April 17, 2019, at 5:00 p.m. EDT. If you live outside Connecticut, contact us to set up a Connecticut taxpayer advocate for the upcoming filing season. Information about the Connecticut E-file portal can also be found at CT.gov/efile. Connecticut Tax Deductions Connecticut has a number of deductions, which can be taken as a credit against other taxes and used to reduce the amount you owe.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2AS for Stamford Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2AS for Stamford Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2AS for Stamford Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2AS for Stamford Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.