Award-winning PDF software

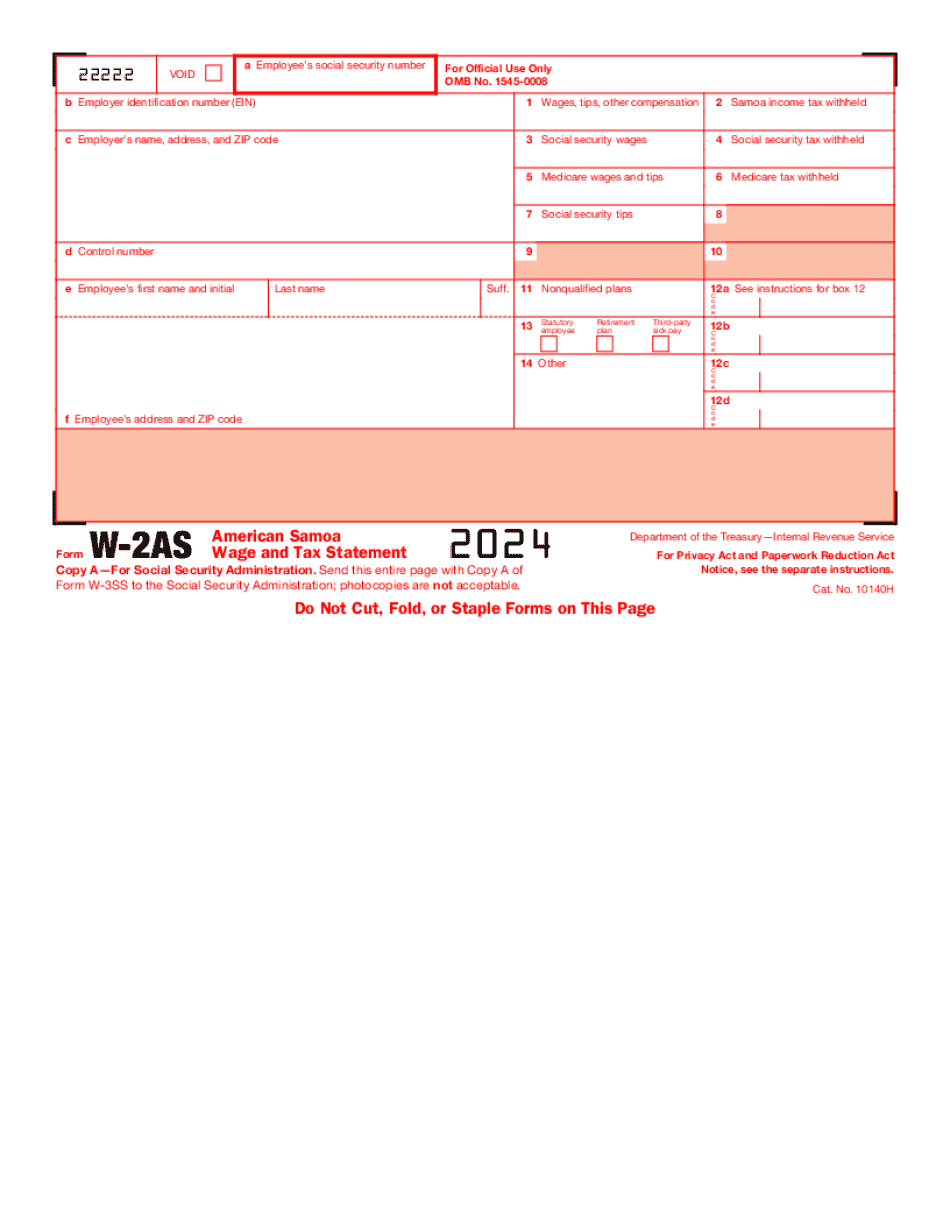

Form W-2AS Anchorage Alaska: What You Should Know

Tax Return for Federal Employee Payroll Deductions and claimed credit for non-employer deductions for Alaska. The State of Alaska may not approve that amount as employment income. The defendant is charged with three counts of knowingly presenting a false tax return on or before June 1, 2014, and one count of knowingly making false tax statements before the end of 2025 or the beginning of 2014. The tax claims and returns were submitted using various aliases and fake social security numbers. The defendant has denied the entire accusation through his attorney. He is currently in custody while awaiting trial; however, we can confirm he faces four separate counts of tax violations. ALASKA FEDERATION The Department of Labor and Workforce Development does not provide tax forms for the state of Alaska or American Samoa. Please use these resources to determine if there is an appropriate form for you: Federal Tax Form W-2 Federally recognized American Samoa government-subsidized wage account American University of Anchorage's W-2 forms American Samoa Department of Finance American Samoa Department of Revenue AURORA — Property Tax Return Deadline: The Tax Collector's Office will not issue a return under this section of the law unless you receive a certified paper copy of the return within forty-five days after the time your state income tax was due. In addition, there are other exceptions to filing the form. The form shall be filed with the Division of Property. For assistance in determining if you are eligible to file a Return of Property Tax Exemptions, please contact the Office of Public and Corporate Disclosure. The deadline for providing certified paper returns is June 01 – September 30, 2014. You may file any time, but the fee must be paid within thirty (30) days of filing. The following are the required fields: 1. Your last name: 2. Your married name (if you have received any marriage-related credits) 3. Your residential address/street address: 4. Any additional information you may need 5. If applicable, the name of any dependent child listed (if any) 6. If the amount of tax that you have paid on the return is more than the amount of tax that you paid last year, attach a copy of your income tax return for that year showing the amount of tax that you paid. 7. The county or district where you live. NOTE: The address listed in this section on your return shall be in Alaska. 8.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-2AS Anchorage Alaska, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-2AS Anchorage Alaska?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-2AS Anchorage Alaska aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-2AS Anchorage Alaska from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.