Award-winning PDF software

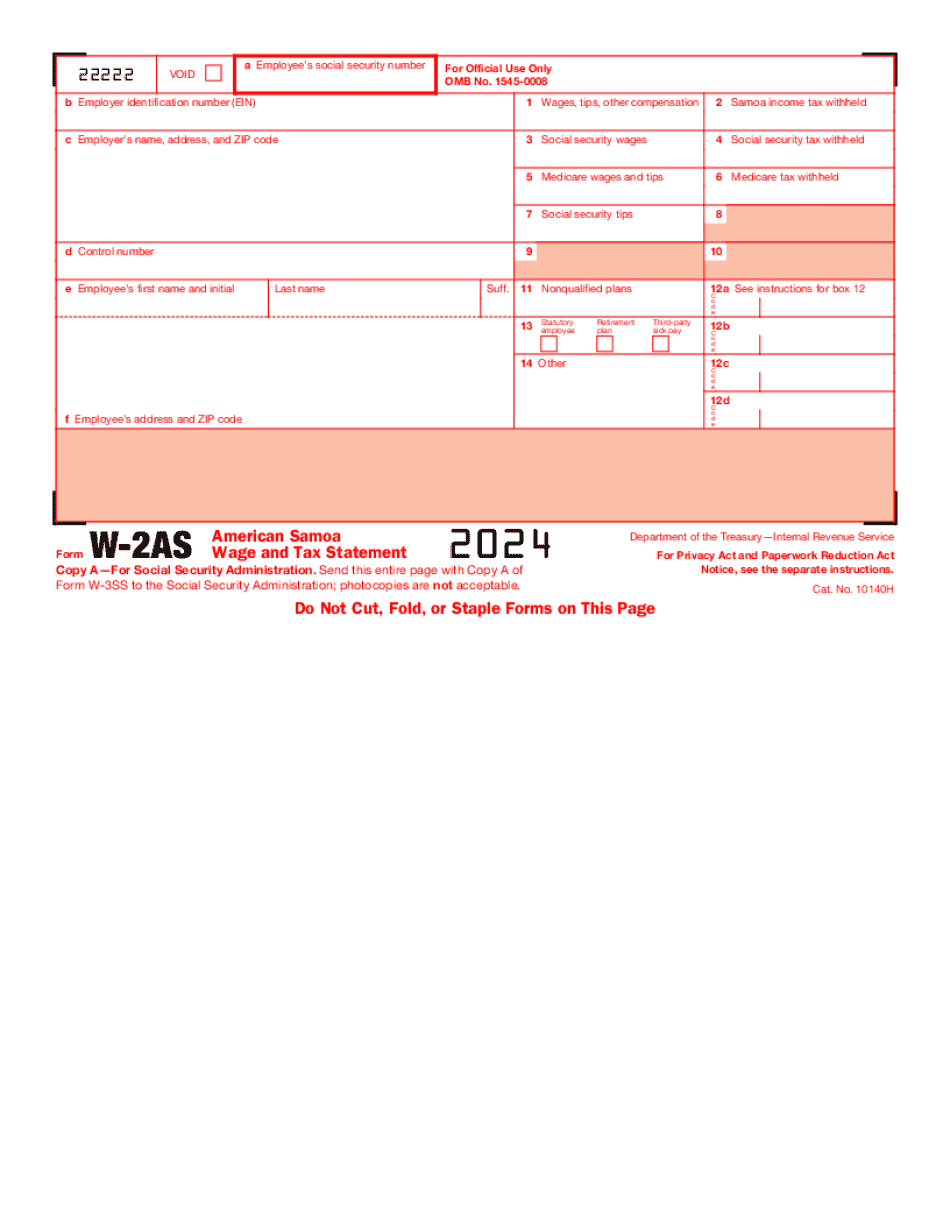

Form W-2: Wage And Tax Statement - Investopedia: What You Should Know

The tax treatment of a gift, trust, and inheritance is not just a matter of law, but is governed by regulations adopted by the IRS, the Department of the Treasury, and the Internal Revenue Service in order for U.S. persons to comply with tax regulations. IRS Form 3520: Tax Guide to Foreign Gifts, Trusts, and Feb 2, 2025 — The foreign trust or estate may be treated as domestic for U.S. tax purposes even if it has made a reportable gift during the year to a U.S. beneficiary. However, the recipient must still furnish evidence to substantiate the proportion of the value of the gift, trust, or inheritance received by the U.S. beneficiary and file a Form 3701, Filing Form 706 for U.S. reportable gifts. Other Tax Provisions IRS Pub. 556, Tax on Foreign Corporation Transfer, may be useful in understanding the tax consequences of “real property transferred by way of exchange” and certain other tax provisions such as § 642(a)-12. The “United States,” “U.S. Territories, and Possessions,” and “Nations other than the United States” include all [other] domiciles, U.S. jurisdictions, possessions, and territories. Report to IRS by Financial Institutions (1) Foreign financial institution. An institution described in paragraph (c)(2) of this section must file a Form 4797 if-- (i) A fiduciary of the institution, including a broker, trader, or administrator, delivers or causes to be delivered to the institution, or a related person as defined in paragraph (c) of this section, a reportable gift of more than 50,000 or a real property transfer that results in a gain of 10,000 or more; or (ii) A transaction or series of transactions with respect to which section 1031 or 1112 is administered or completed. A foreign financial institution that provides financial services to persons in the United States must notify the IRS of any significant changes to such services with the Department of Treasury. (2) Financial institution. The term “financial institution” means a bank, trust company, exchange, savings and loans, or credit union.

Online alternatives help you to organize your doc administration and enhance the productivity within your workflow. Carry out the fast guidebook with the intention to total Form W-2: Wage and Tax Statement - Investopedia, refrain from glitches and furnish it in a well timed fashion:

How to finish a Form W-2: Wage and Tax Statement - Investopedia internet:

- On the web site along with the variety, click Begin Now and pass for the editor.

- Use the clues to fill out the pertinent fields.

- Include your own material and call knowledge.

- Make certainly which you enter appropriate data and figures in appropriate fields.

- Carefully look at the subject matter on the sort at the same time as grammar and spelling.

- Refer that can help part if you have any problems or handle our Support crew.

- Put an electronic signature on the Form W-2: Wage and Tax Statement - Investopedia using the assist of Indication Tool.

- Once the shape is accomplished, push Carried out.

- Distribute the all set sort through e-mail or fax, print it out or save with your gadget.

PDF editor helps you to definitely make improvements with your Form W-2: Wage and Tax Statement - Investopedia from any world wide web connected product, personalize it in line with your needs, sign it electronically and distribute in several tactics.