Filling out Form W-2AS online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

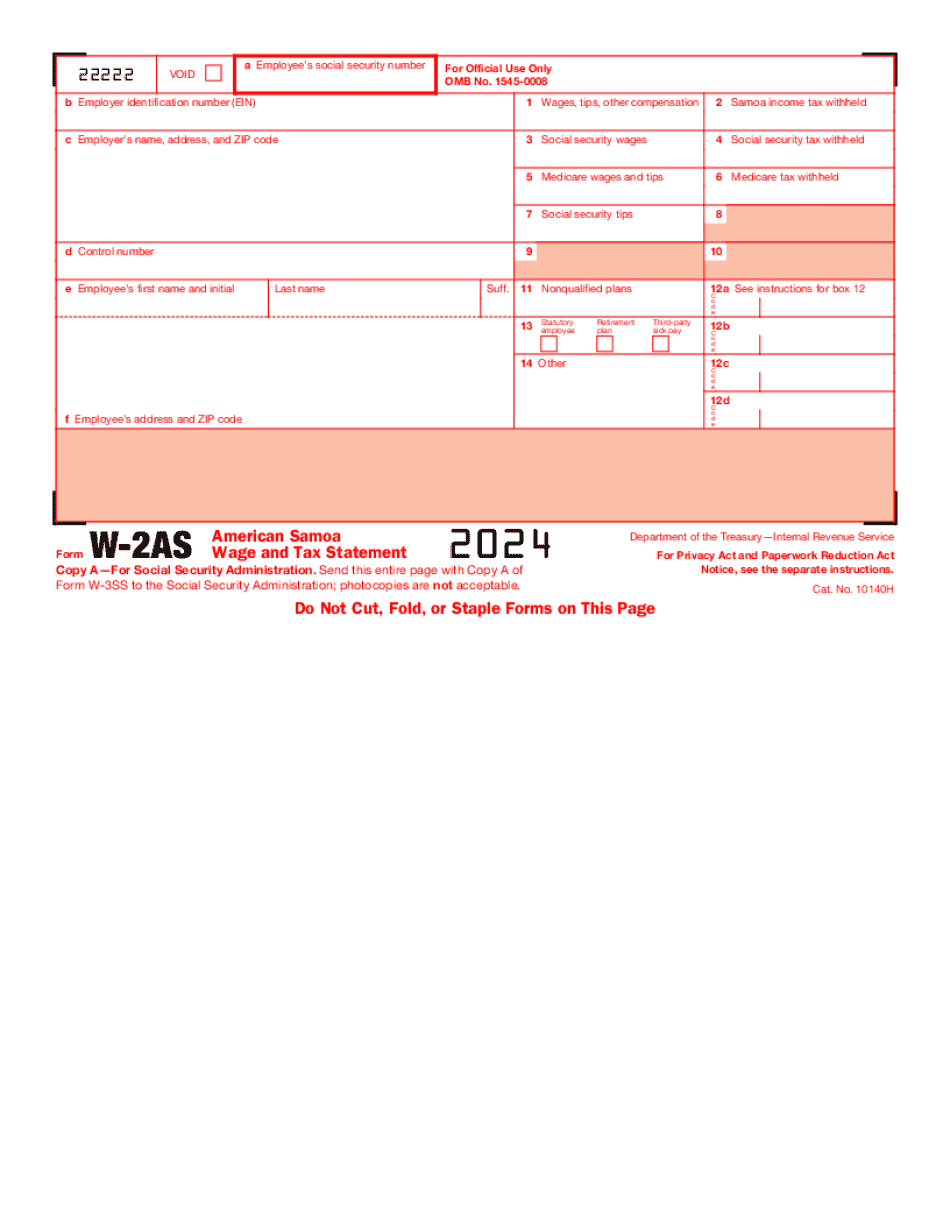

A full guide on how to Form W-2AS

Every person must declare their finances on time during tax period, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form W-2AS, our secure and straightforward service is here to help.

Make the following steps to Form W-2AS quickly and efficiently:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Complete your document utilizing the Text option and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Take advantage of the Highlight option to accentuate specific details and Erase if something is not relevant anymore.

- 06Click the page arrangements key on the left to rotate or remove unwanted document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or select Mail by USPS to request postal report delivery.

Select the most efficient way to Form W-2AS and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 2025 W2 Form?

Online technologies help you to arrange your document management and improve the productivity of your workflow. Observe the quick tutorial so that you can complete IRS 2025 W2 Form, keep away from mistakes and furnish it in a timely way:

How to complete a fill in form w 2?

- 01On the website with the document, press Start Now and move towards the editor.

- 02Use the clues to complete the appropriate fields.

- 03Include your individual data and contact data.

- 04Make absolutely sure you enter right information and numbers in proper fields.

- 05Carefully check the data of the form as well as grammar and spelling.

- 06Refer to Help section if you have any questions or contact our Support staff.

- 07Put an digital signature on your 2019 W2 Form printable while using the help of Sign Tool.

- 08Once document is finished, click Done.

- 09Distribute the prepared document via electronic mail or fax, print it out or save on your gadget.

PDF editor will allow you to make improvements towards your 2025 W2 Form Fill Online from any internet linked device, personalize it in keeping with your needs, sign it electronically and distribute in several approaches.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form W-2AS?

The purpose of Form W-2AS is to report the net income of an employee. This is used for tax purposes, such as social security and withholding tax, and to ensure that the correct amount of social security and Medicare taxes is paid. It is also used to report wages paid, which are an integral part in an employee's pay check. The net income is calculated on a line that is separate from the W-2 for each pay period.

The amount reported as W-2A is used for employment taxes. It includes the income that is reported as income on Form 1040-ES, the form that workers file with their regular paychecks. The 1040 doesn't include some of these reported income, such as Social Security benefits. Since wages reported as 1040-ES income are subject to Social Security and Medicare taxes, reporting as W-2A will also help prevent the tax being paid twice.

If the reporting of W-2A on the Form W-2AS does not cover all types of wages paid to an employee, the Form W-2AS should be modified to include other types of wage information. You can view sample versions of Form W-2AS and W-2A on our Forms Page.

Who should complete Form W-2AS?

Employees of any business and certain independent contractors who do not receive wages for their services should complete Form W-2AS. The forms are made available on the IRS website.

Note: When an employee's wages are subject to federal income tax withholding, Form W-2AS is only necessary if the employee is required to file a Form 1040 and/or Form 1040A before the end of the business year. If the withholding tax deadline has passed, the employee should complete Form W- 10 and attach it to the correct form of Form 1040. For more information on withholding, see Publication 519.

How do I use Form W-2AS?

If you have employees, provide them Form W-2AS. If you only have independent contractors, provide them Form 1041 or Form 1041A.

If you have employees who file a Form 1040 and/or Form 1040A, use Form W-2AS, so an employee can provide payment for all or part of their share of business-related expenses. In that case, the Form W-2AS must be sent only to employees of the business. The employee can't use the form to pay employees other than the employee or an agent of the employee.

If you have independent contractors who don't file a Form 1040 or Form 1040A, use Form W-10.

You don't need the employee's signature on a form if:

The employer and the employee sign it.

Form W-2AS is accompanied by the applicable Form 1095-C, Form W-9, or Form W-2G, and

The form shows that it received the employee's signature.

You don't need the employee's signature if:

The form is accompanied by a separate statement.

See also:

Form W-2AS is also available on IRS.gov.

When do I need to complete Form W-2AS?

You must file your W-2AS with the IRS each pay period. You must file the form no later than May 15. However, if you don't file Form W-2AS by May 15, you automatically receive a Form W-2 from the employer that should have been filed with the Form 1099-MISC.

This form is the third of these three reports and the last one you will receive as a U.S. employee. If an international employee, you should receive one of these forms. You should file a copy of Form 1099-MISC with the IRS no later than May 15. However, you do not need to file Form W-2AS with the IRS in connection with your foreign-source income, because it is reported from the IRS.

A check or direct deposit that isn't completed by May 15 should be used to make payment for your employer's non-U.S. employees.

Filing Information: International Nonresident Alien Employees

When you do not pay U.S. federal Social Security tax on wages and salary paid by a foreign employer, your employer will report to the IRS a foreign earned income exclusion equal to the least of:

the U.S. employer's share of U.S. social security tax for the pay period that includes the pay period in which the wages and salary are paid; or

The full U.S. employer's tax imposed on its share of U.S. social security tax for the pay period.

If you pay U.S. social security tax on wages and salaries outside the United States, the IRS will report that income to the appropriate tax agency in the same manner that the U.S. employer is required to report income and expenses to the IRS. For information on this procedure, see Publication 515, Withholding of Social Security Tax and Information Returns.

Filing Information: International Parental Allowances and Dependent Care Benefits

The IRS requires some companies to withhold Social Security, Medicare, and Medicaid taxes on wages paid to or through their foreign affiliates. If you do not pay the taxes to these same foreign employers, the IRS imposes penalties on you at the rate of 10% of your annual foreign source withholding (if you pay this income in a calendar pay period, that's your entire tax for the year), and 10% of the following, if you don't receive a Form W-2AS.

Can I create my own Form W-2AS?

Yes, you can create your own Form W-2AS. You can use this form to get free federal tax return preparation services at the United States Department of Treasury. The information in the Form W-2AS is for use by the IRS only and not for any other purpose. This information is confidential and should not be used for any purpose other than to prepare a federal tax return. Your use of this form to prepare federal tax returns is subject to the same restrictions and limitations that apply to IRS-operated free online tax preparation services.

Note: When you use the following form to prepare your federal tax return, you are accepting legal responsibility for all the information you provide as the taxpayer. If you have any questions related to your federal tax return preparer, please call a Volunteer Tax Help Line at. If you have any questions not related to your federal tax return preparer, please call for IRS assistance. It is important that you complete and sign the form. If you do not receive a return prepared by a Form W-2AS preparer within three business days, you can request a refund of your federal income tax. For further assistance, or to request a free federal return preparation, please visit our website.

What information must I give in the form?

Please provide your full name, home address, Social Security number (SSN), SSN1 and 2, driver's license/other government-issued photo identification or your foreign passport number if you are not a U.S. citizen.

What information will be reported on the form?

You must provide your full name, SSN, date of birth, country of issuance of your passport, marital status, citizenship status and address. Additional identification required if you do not have a picture identification.

Do you offer free federal tax return preparation?

Yes! We have free federal tax return preparation for all taxpayers, no matter how they file. We have offices in most states across the country.

When are you open?

You must register with us before we can prepare a federal tax return. If you register online, we will not need to open a new account for you with us. If you need your tax return prepared or to correct your information, you must call. If you live outside a federal district, we will need to open a federal account for you.

What should I do with Form W-2AS when it’s complete?

When your Form W-2AS is complete you have to file a UCC form that will show your employer and the amount you pay them. The form must be filed in the United States. If you earn 9,000 in U.S. wages in a one-month period, that is not enough to file as an independent contractor.

The same rules apply to Form W-2AS that apply for IRS Form W-2A. The same penalties apply for not filing these forms as they do for failing to file IRS Form W-2A.

For additional information about UCC Forms click here.

How long does it take for Form W-2AS to be filed in the United States?

The time it takes to file Form W-2AS depends on a number of factors including the reason for filing the forms such as:

If you are a self-employed individual or business, if you are an employee, the total income from business income and from independent contracts.

If you are self-employed, there are separate schedules for taxes withheld from your earnings on Form 1040 in U.S. currency. For more information and specific dates refer to the Instructions for Form W-2AS.

If you are an employee, you have to file IRS Forms W-2 and W-3, which are used to compute your net wages, and pay tax on those wages. To claim your wages as an exemption, you will need to file Forms 1040NR, 1040NR-EZ, 1040NR-SPG, and 1040RTR (Form 1040).

For more information on IRS Forms W-2 and W-3, click here and the Instructions for Form W-2AS.

Are there penalties for not filing the Form W-2AS?

Form W-2AS must be filed at the time you earn taxable wages and, if you use a service business or an Zone business, they are subject to a minimum 3% withholding rate (as of 2018). That means, if you earn 500 in wages in a month, and you owe 10% withholding, that means 100 will be withheld each pay period from your wages. The Form W-2AS can be electronically filed, if you do not have a paper copy.

If you miss the deadline to file a Form W-2AS, you will be subject to the penalties of not having paid taxes by that date.

How do I get my Form W-2AS?

You can request your Form W-2AS online. Once your Request for Release of Returns and Payroll Information form is approved, you will receive your Form W-2AS. This form also provides you with income tax forms to fill out and file.

You can contact us by filling out our online Form Request for Release of Returns and Payroll Information form, downloading it, or mail it or fax it to:

Internal Revenue Service

P.O. Box 2000

Charlotte, NC 28

(Please reference Form W-2AS as the form).

Do all employees have to file a form?

Employees who perform clerical or non-wage work, such as bookkeeping, are not required to file a Form W-2AS. However, some employees, such as janitors, are required to file a Form W-2AS.

What if I have not received my Form W-2AS? What should I do?

Check your employer ID on an IRS form known as Form W-2G (formerly W-2G Instructions). If you are the employee listed for employment, or the responsible individual listed on the form, you must submit the Form W-2G. If you are the employer who must file Form W-2B, use the same Form W-2G form that you would have used to submit the Form W-2B.

You don't have to submit Form W-2G if your employer ID on Form W-2G is different from your business ID on Form W-4G (formerly W-4G Instructions). We recommend you submit Form W-2G. This form provides additional information about your employment and what you should do with your Form W-2AS.

The Form W-2A form is used by the IRS if you are a self-employed individual or a sole proprietor who are not a sole proprietor holding more than a 10 percent trade, business or investment interest in another company. If your employment status is self-employed, you should use Form W-2G if your income does not meet the standard Form 1040EZ limits.

The Form W-2A form includes information about your self-employment or the related self-employment income to determine both whether you filed a tax return and how much tax you are owed.

What documents do I need to attach to my Form W-2AS?

If you receive a wage or salary check from a covered employer, you must attach two (2) documents to your Form W-2AS with the information you want to appear on the Form W-2AS.

The documents must be originals (not copies), in your own handwriting, and signed and dated by you. Your signature may be required by your employer. See the Instructions for Form W-2AS for the more detailed information about how to attach, sign and date a required document.

For more information about the information you need to attach to the Form W-2AS, see the Instructions for Form W-2AS.

Wage and Salary Credit

You can get a credit on your Form W-2AS by you or your employer for the wages or salaries you paid to a covered employee in support of their job search. The amount of the credit you can get depends on whether you are entitled to the credit or not. You get a credit by reporting the wage or salaries of an employee to your employer on Form W-2AS.

The table below shows the amount of credit you can get on Schedule C and under. For purposes of claiming the wage or salary credit for self-employed individuals, a self-employed individual is, for purposes of the table, a person that does not own or operate a business.

For more information about the wage and salary credit, see Publication 519, Wage and Tax Guide for Small Business, and Publication 519-A, Payroll Deductions and Remittances.

Employee or self-employed individual Tax status Amount of credit 1 Yes 2 Yes 3 Yes 4 Yes 5 Yes 6 No 7 No 8 No 9 No 10 No

If you don't have any wages or salaries to list on the return, and you are entitled to claim the credit, use your estimated credit of 75, plus 2 of tax.

If you want to claim the credit on a return for other purposes, you have to itemize your deductions and pay the IRS all the amounts in full. If you don't, you could owe a tax amount on the amount you claimed for the credit, and the credit won't be reflected on the return.

Exemptions

If you pay your own wages or salaries to a self-employed employee, you don't have to include as wages or salaries in the income statement the value of the wages or salaries.

What are the different types of Form W-2AS?

You must complete each form for each of your employees and include each Form W-2AS you received.

Forms W-2A, Form W-2B, and Form W-2C are filed with your state-licensed payroll services agency. These forms are usually sent to their respective state tax offices.

Employee's Statement of Additional Information (ESA)

You must file Form W-2A, Employee's Statement of Additional Information, if you want to show that a qualified HRA was provided to an employee. You may use Form W-2A as your primary source to figure the federal, state, and employee tax withholding based on the income and total compensation of the employee under the new rule.

If you have already received Forms W-2A or a similar form from your state-licensed payroll services agency, you should provide them with copies of Forms W-2A or copies of Form W-2CS.

For the latest information from the IRS regarding Form 1099-K. For an electronic copy click here.

Form 1099-B, Annual Consolidated Statement of Transactions

To send Form 1099-B, your gross profit or your gross loss, to your state-licensed payroll services agency, or to the IRS online, go to IRS.gov to register for an account and select “Go to IRS.gov.” Use the “Select a Solution” section to select your payroll services agency or use the “Create your own solution” area to create your payroll solution. From the “Select Form Type” section, select Forms W-2A, Forms W-2B, and Forms W-2C. If you are sending Form 1099-B by email, use the “Create your own solution” area to generate a unique file that you may send to your state-licensed payroll services agency or IRS.gov.

For the latest information from the IRS regarding Form 1099-B. For an electronic copy click here.

If you do not have a payroll services agency in your state, or do not want to file a Form 1099-B with your state tax agency, you can file Forms W-2A or Form W-2B by mail. First, fill out Form W-2A or Form W-2B. Mail the completed form to your state-licensed payroll service or IRS.gov, where it will be available online for download.

How many people fill out Form W-2AS each year?

The number who complete Form W-2AS varies. The government generally estimates about one-fourth of all W-2 workers are self-employed.

Some estimates suggest that one-quarter of all full-time employees and two-thirds of all part-time employees file this form. When a family works more than half of the workweek, the employer files this form.

Some industries have an enrollment higher than others, even as they have different employee counts.

For example, manufacturing employees account for nearly a quarter of all Form W-2 filers in the construction industry, but only 13 percent of manufacturing employees.

Are all of your employees on this Form W-2AS?

Forms W-2AS contain information on each employee (and spouse) but not all of an employee's wages and taxes. The employer must then withhold, pay and issue a federal income tax return for each employee.

For example, an employee may have wage garnishment procedures depending on how much wages the employee was paid for his or her work. In some cases, wages from more than one job may be pooled and paid once a year. In other cases, wages may be paid monthly, even if the employer and employee disagree on such payments.

Form W-2AS doesn't require employees to report any taxes paid on their own.

What happens if employees fill out Form W-2AS incorrectly?

Employees typically fill out Form W-2AS in three parts:

Payroll Tax, which is the taxes withheld from payroll taxes: Federal Social Security and Medicare income taxes (FICA); income taxes from state and local governments; and unemployment taxes.

Tax on Additional Employee Compensation, which is a tax on all wages and compensation paid to employees, usually above the minimum wage.

Employee's Estimated Tax, which helps employers estimate the IRS filing requirements of their employees. (Employees also can fill out Form W-2AS in its entirety.)

The employer then must report this information to the IRS.

Employers usually have to compute and prepare Form W-2AS and file its tax forms separately. The individual who filled out Form W-2 will be called the payer. The payer will also report what taxes are owed to the IRS, along with his or her Form W-2AS payee identification number.

Is there a due date for Form W-2AS?

The due date for Form W-2AS is the last day of the last month preceding the month in which the information is to be filed. See Publication 15-A for information on the due date for Form W-2AS. Am I required to file Form W-2 for my employee? No. You do not have to file a Form W-2 for an employee. See Regulations section 1.1425-8(a)(2) for information on what other types of records do not have to be kept under subsection (a)(3) of section 3121. Am I entitled to an employee discount? An employee discount is the reduction in the amount you must pay to your employee on Form 1099-MISC. See Regulations section 1.1465-8(c)(2). How do I report Form 1099-MISC? To report Form 1099-MISC on Form 1040, Form 1099-R, or Form 1099-INT, enter either the entire number of shares or, if the Form 1099-MISC includes any Form 1099-B, Form 1099-B-E, or Form 1099-BK, indicate the number of shares by a percent sign () and then follow the space bar (10). If you use a percent sign in any of the boxes for the number of shares, enter the numbers as a percent sign (“%), except for the box labeled “Amount.” For a box that says “Amount,” enter the amount in thousands and cents, except for the box labeled “Rent.” Enter the box labeled “Non-employee directors.” Enter the percent (0% if the Form 1099-MISC is not accompanied by a Form 1099-B, Form 1099-B-E, or Form 1099-BK). Enter “Dissenters” in this box. For instructions on how to fill out this area, see the Instructions for Form 1099-MISC.

If the Form 1099-MISC does not include the name and type of the employer and employees, indicate “None.” Enter “Not applicable,” in this box.

If the Form 1099-MISC includes more than three lines, the number of shares is shown in the first line and the total number of shares is shown in the last line.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here